SaaS Solutions for Private Equity Investors are increasingly becoming the cornerstone of successful investment strategies. With their recurring revenue models and predictable cash flows, these solutions present a compelling opportunity for investors.

Yet, navigating this landscape can be complex and challenging. How do private equity firms determine which SaaS companies offer the best return on investment?

This is where we step in.

We delve into the world of SaaS Solutions for Private Equity Investors, exploring why they’re attracting significant interest from venture capital firms and how management teams play a crucial role in securing investments.”Private equity’s attraction to SaaS has been growing significantly since 2012 with an average annual growth rate of 20%”— Bain & Company

The Rise of SaaS Companies and the Attraction for Private Equity Investors

Since 2012, a remarkable trend has emerged in the investment landscape. Private equity investors have increasingly taken an interest in Software as a Service (SaaS) businesses, due to the reliable and steady revenue streams that such subscription-based models can provide.

This shift is largely driven by an appreciation for subscription-based recurring revenue models that offer both predictability and stability – key attributes sought after by savvy private equity firms investing in this space.

Uncovering the Hidden Keys of SaaS Value

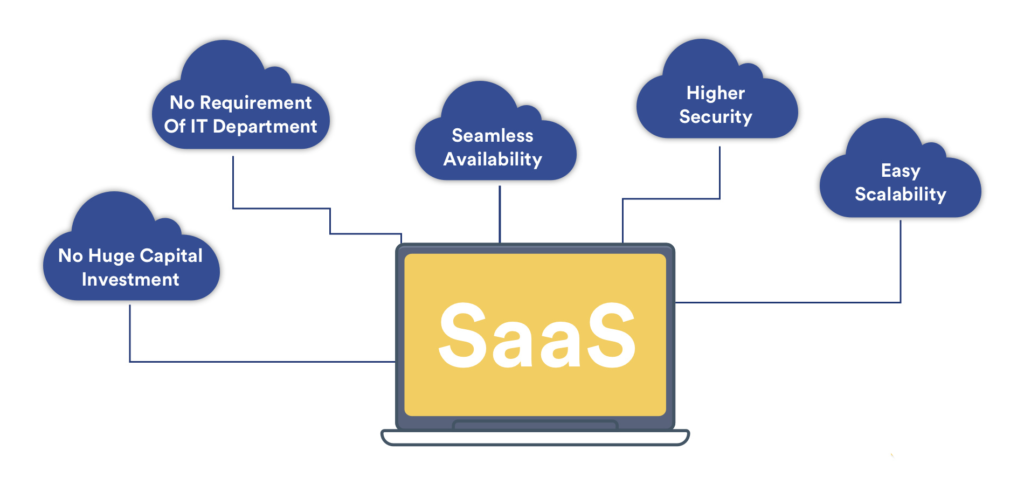

SaaS businesses are not just attractive due to potential profitability; they also hold inherent value within them. This intrinsic worth stems from five hidden keys: scalability, high gross margins, predictable revenues, sticky customer relationships, and low capital requirements.

All these factors contribute significantly to high valuations seen among successful SaaS startups today. It’s no wonder then why PE firms find such investments irresistible.

Beyond base features though lies another alluring aspect – numerous add-ons can be incorporated into existing platforms with relative ease. The ability to increase product offerings without substantial risk or investment makes SaaS businesses even more enticing prospects for PE firm portfolios.

As such, quick returns on investments become crucial, which often necessitates exploiting those aforementioned hidden keys of value within these businesses.

Next up, we delve into some leading venture capital firms who’ve recognized this immense potential nestled within numerous SaaS companies.

Since 2012, private equity investors are increasingly eyeing SaaS companies for their scalable, high-margin and predictable revenue models. Discover why these firms find such investments irresistible. #PrivateEquity #SaaSInvestmentsClick to Tweet

Top Venture Capital Firms Investing in SaaS Startups

SaaS Solutions for Private Equity Investors: The venture capital landscape is abuzz with the promise of SaaS startups. The unique business model, coupled with their potential for high returns, has drawn significant attention from numerous venture capital firms.

Accel Partners’ Impressive Portfolio Investments

In this space, Accel Partners, a leading name, stands out by being the initiating or lead investor in over 70% of its portfolio companies. This strategic approach allows them to guide and shape these businesses right from inception.

A case in point is DocuSign – a company that revolutionized digital signatures and document management. Other successful investments like Dropbox and Slack have become industry staples across various sectors.

Differentiating itself from Accel’s strategy, Matrix Partners’ investment philosophy centers on openness when evaluating potential investments. They see beyond polished pitches to understand core value propositions offered by each startup they consider investing in.

This merit-based evaluation process helps unearth promising ventures capable of delivering substantial returns while contributing positively through innovative solutions within their respective sectors.

The pivotal role played by top-tier venture capital firms such as Accel Partners and Matrix Partners cannot be understated as they continue supporting numerous SaaS companies globally.

Next up, we delve into how crucial strong leadership within a company becomes when attracting both PE investors and VC firms.

Venture capital firms like Accel Partners and Matrix Partners are making waves in the SaaS startup scene. Their strategic investments, from DocuSign to Dropbox, shape industries. #SaaS #VentureCapitalClick to Tweet

The Role of Management Teams in Attracting Equity Investors

Equity investors place a significant amount of importance on the management team when considering potential investments. Investing in companies is about investing in the people who lead them, such as Jason Lemkin – a founder and investor known for his successful exits.

A standout example is Jason Lemkin,

a founder and investor known for his leadership skills that have led to several successful exits. Lemkin’s ability to strategize effectively and execute flawlessly has made him an attractive figurehead for equity investors. This exemplifies how strong management can be pivotal in attracting substantial investments.

Determinants For Successful Exits: The Importance Of A Strong Management Team

Investing in companies isn’t just about numbers, it’s also about people. A strong management team like Jason Lemkin’s can be a game-changer for equity investors. #PrivateEquity #SaaSClick to Tweet

The Appeal of Cash Flow and Capital Efficiency

Private equity investors typically prioritize cash flow when investing in SaaS companies, understanding that consistent revenue streams can cover operating costs. A company with robust and predictable cash flows is always on their radar because this signals consistent revenue streams that can cover operating costs.

Cash isn’t the only king here; capital efficiency also wears the crown.

Capital efficiency refers to how effectively a business utilizes its funds to generate profits. If you think about it as getting more bang for your buck, then an efficient firm will produce higher returns on invested capital (ROIC).

Evaluating Capital Efficiency in SaaS Companies

To gauge a SaaS company’s prowess at managing resources efficiently, savvy investors turn towards key metrics such as Customer Acquisition Cost (CAC) Payback Period or Lifetime Value/Customer Acquisition Cost (LTV/CAC). These ratios offer insights into whether investment dollars are being converted into profitable growth successfully.

In simple terms: they assess how quickly customer acquisition costs get recovered through subscription revenues—a shorter payback period implies greater capital efficiency—and what return each dollar spent acquiring customers fetches over their lifetime relationship with the enterprise.

Cash Flow Management Strategies for SaaS Businesses

Adept management teams understand that maintaining healthy cash flows requires strategic planning and decision-making. Some effective strategies might include offering annual payment options or volume discounts. Both these tactics not only accelerate incoming payments but also help foster long-term relationships with clients by providing them value-for-money deals.

Now let us move forward to explore ‘The SaasTr Fund’ unique investment criteria – another fascinating aspect of investments in SAAS startups.

Investing in SaaS? Look for strong cash flow & capital efficiency. Savvy investors use key metrics like CAC Payback Period and LTV/CAC to gauge profitability. #PrivateEquity #SaaSInvestmentsClick to Tweet

SaaStr Fund’s Unique Investment Criteria

SaaS Solutions for Private Equity Investors As an investor, it is crucial to understand the unique investment criteria of The SaaStr Fund. Unlike other venture capital firms, this fund exclusively invests in SAAS startups that have earned unaffiliated customers independently.

This strategy sets them apart from their competitors and provides a clear direction for their investments.

The famous Benjamin Franklin quote comes to mind: “Diligence is the mother of good luck.” This rings true when considering how The Saastr Fund operates. Their diligent focus on companies with proven market traction without any third-party affiliations or partnerships ensures these businesses already possess in#nt growth potential and sustainability – attributes highly valued by investors.

It might seem unconventional at first glance but look deeper into why they choose such a path:

Their belief in resilient companies with scalability prospects forms the core rationale behind this approach. Companies who’ve convinced real-world users about their value proposition independently demonstrate both product quality and sales prowess – key indicators for success within competitive tech landscapes like SaaS.

Digging further into what makes up ‘the next big thing’ as per The SaasTr Funds’ philosophy, you’ll find innovative solutions capable of disrupting existing markets while creating new ones are given priority. Find out more #.

Navigating Challenges & Opportunities In#nt To Such A Strategy

An obvious downside would be limiting eligible investments due to stringent criteria which requires thorough due diligence coupled with keen business insight. But every cloud has its silver lining. Overcoming hurdles offers immense rewards too.

A startup meeting such strict standards indicates better positioning for long-term success given demonstrated ability attracting organic customer base – vital indicator sustainable growth within tough competition present in today’s software-as-a-service (SaaS) landscape. Learn more #.Transitioning our focus now from one distinctive VC firm’s strategy let us delve into another renowned investor group known for its preference towards creative founders- Sequoia Capital.

Key Takeaway:

The SaaStr Fund’s unique investment strategy, focusing solely on independent SaaS startups with proven market traction, might seem restrictive but offers potential for high rewards. It underlines the fund’s belief in resilient companies and their ability to disrupt markets while ensuring long-term success.

Sequoia Capital’s Focus on Creative Founders

In the realm of venture capital, Sequoia Capital is recognized for their attention to imaginative entrepreneurs. The firm is convinced that innovative thinkers are key to driving a SaaS company towards success.

This belief has led them to invest in several top-tier SaaS companies such as Square and Zoom.

The founder of Square, Jack Dorsey, also co-founded Twitter. His creativity disrupted an entire industry with his fresh take on payment processing systems. This innovation revolutionized how businesses handle transactions today.

Zoom was developed by Eric Yuan who designed this user-friendly video conferencing platform at a time when existing solutions were complicated or inefficient.

This commitment extends beyond just product development; it influences every aspect of business operations.

Moving Forward With Creativity

Innovation continues to be the engine behind successful startups – especially within the fiercely competitive SaaS space. As investors seek high growth potential, they often turn their attention towards ventures helmed by imaginative individuals who dare think differently.

Next up we delve into Andreessen Horowitz’s stage agnostic approach which allows flexibility across all stages.

Venture capital giant, Sequoia Capital, bets big on creative founders to drive SaaS success. With investments in innovators like Square and Zoom, they’re shaping the future of tech. #VC #SaaS #InnovationClick to Tweet

Andreessen Horowitz’s Stage Agnostic Approach

One such firm, Andreessen Horowitz, has set itself apart by adopting a stage agnostic approach in its investment strategy.

This unique methodology allows them the flexibility to invest across all stages of a company’s lifecycle.

In the words of Benjamin Franklin: “Diligence is the mother of good luck.”

By being prepared and flexible enough to seize opportunities at any point in a business’s journey – from seed funding rounds right up until late-stage investments – they’ve positioned themselves as one of the most adaptable players in this competitive field. This adaptability particularly shines when it comes to SaaS businesses.

SaaS Businesses & The Stage Agnostic Strategy

SaaS Solutions for Private Equity Investors The dynamic nature inherent within Software as a Service (SaaS) companies makes them an ideal fit for Andreessen Horowitz’s stage-agnostic investing style. These businesses often experience rapid growth phases that require different types and levels of support; something which can be readily provided by investors who aren’t bound by rigid criteria or timelines. Learn more about SaaS here.

A Successful Investment Example: Asana and Coinbase

To better understand how effective this approach can be, consider two notable examples from their portfolio – Asana and Coinbase. Both are high-performing SaaS entities whose success was bolstered through timely injections courtesy of “The Flexible VC,” i.e., Andreessen Horowitz.

This ability not only enabled early access but also allowed significant influence over these ventures’ trajectories while ensuring substantial return once those organizations matured further down their respective paths.

Moving Forward with Bessemer Venture Partners

Few things remain constant in private equity circles except perhaps change itself. After exploring Andreessen Horowitz’s innovative practices, let us now turn our attention towards another titan known for strategic moves – Bessemer Venture Partners.

Key Takeaway:

Andreessen Horowitz’s stage-agnostic investment strategy, which allows them to invest at any point in a company’s lifecycle, has proven successful especially with dynamic SaaS businesses. Examples like Asana and Coinbase showcase the firm’s ability to influence ventures’ trajectories while ensuring substantial returns.

Bessemer Venture Partners’ Impressive Record with Successful Exits

With a rich history that traces back to 1911, Bessemer Venture Partners (BVP) has solidified its position as one of the oldest and most respected venture capital firms in America. Its prowess is particularly notable when it comes to navigating the intricate landscape of SaaS businesses.

The firm’s impressive record speaks volumes.

Astonishingly, BVP boasts involvement in over 120 IPOs and more than 190 successful exits overall. This remarkable success isn’t solely attributed to their financial backing; rather, it’s also thanks to the strategic guidance they provide these companies, helping them reach unparalleled heights.

Digging into Bessemer’s Investment Strategy

BVP adopts an innovative investment strategy known as “roadmap investing”. They pinpoint high-growth areas within technology and healthcare sectors before they become mainstream trends, then invest early into promising startups within those niches.

This proactive approach enables them not only to support but also to nurture groundbreaking ideas from inception through growth stages, eventually leading many ventures towards successful exits via acquisitions or initial public offerings (IPOs).

Celebrating Notable Success Stories

In terms of specific investments made by BVP in SaaS companies, Shopify and Twilio stand out – both are now publicly traded entities boasting multi-billion dollar valuations.

In fact, Shopify was valued at $1 billion during its IPO launch back in 2015. Today, it enjoys a market cap exceeding $150 billion – clearly illustrating BVP’s ability for spotting winners right off the bat.

Likewise, Twilio, a cloud communication platform, had its shares priced modestly at $15 each during its June 2016 IPO. But today, the very same shares trade above a whopping $300, reflecting incredible value creation post-IPO largely due in part to the initial investment made by none other than BVP, along

Key Takeaway:

Bessemer Venture Partners’ savvy “roadmap investing” strategy and strategic guidance have led to over 190 successful exits, including high-growth SaaS companies like Shopify and Twilio. Their ability to spot potential winners early is a testament to their impressive track record in the venture capital landscape.

Conclusion

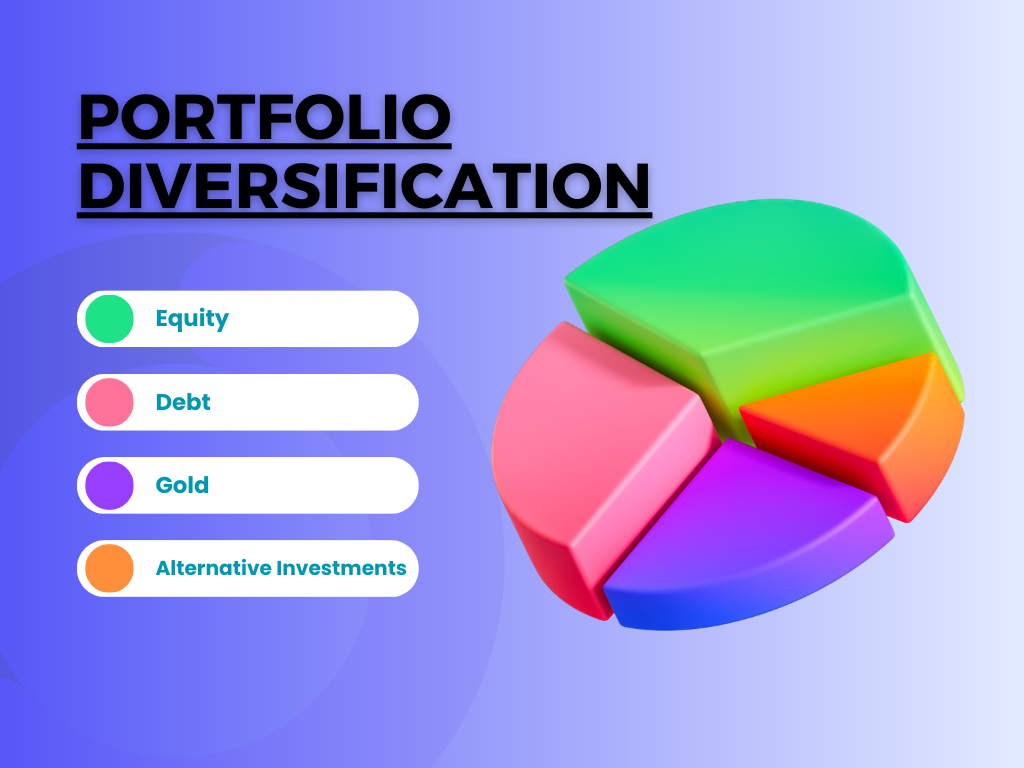

The rise of SaaS companies has caught the keen eye of private equity investors. The allure? Predictable, subscription-based recurring revenue models.

Investment strategies vary among venture capital firms, but a common thread is their recognition of the potential in numerous SaaS startups.

SaaS Solutions for Private Equity Investors

Management teams play an essential role in attracting these investments. Strong leadership can be directly linked to successful exits and high returns on investment.

Cash flow and capital efficiency are two more appealing aspects for PE investors when considering investing in a SaaS company. It’s all about maximizing return while minimizing risk.

SaaStr Fund sets itself apart by only investing in SaaS startups that have earned unaffiliated customers independently. A unique criterion indeed!

Sequoia Capital prefers founders who think outside the box – creative, determined individuals who aren’t afraid to take risks or challenge norms.

Bessemer Venture Partners boasts an impressive track record with successful exits from its portfolio companies; further proof that strategic investment pays off!

If you want to learn more about this, sign up for my newsletter.