Understanding the difference between private equity and venture capital can often seem like a complex task, especially when you’re new to the world of finance and investment.

Navigating through financial news sites, forums, or LinkedIn posts may leave you puzzled with industry jargon. You might come across people debating about which is better – private equity or venture capital?

“Private Equity vs Venture Capital – what’s the difference?” This isn’t as complicated as it seems.

The realm of investments is vast and varied; each type has its own unique characteristics that cater to different types of businesses at various stages. The key lies in understanding these nuances.”Knowledge about investment options contributes 60% towards successful investing.”— Global Financial Literacy Excellence Center

The Fundamentals of Private Equity and Venture Capital

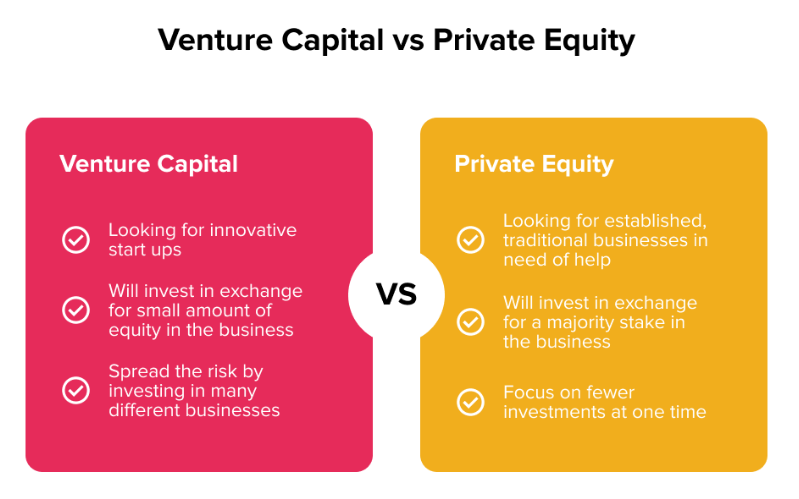

Private equity and venture capital are two of the most important players in the world of investment, with distinct approaches to investing. These financing mechanisms serve as critical lifelines for businesses at different stages. However, their approaches towards investing differ significantly.

Digging into Private Equity:

In essence, private equity investors typically focus on mature companies. They invest in these established entities by acquiring significant stakes – often majority ownership. The goal? To enhance operations, boost profitability, and eventually sell off the company either back to public markets or another firm for a substantial profit margin.

Venture Capital Unveiled:

Moving onto venture capital firms; they set their sights primarily on startups brimming with high growth potential. VC funding involves injecting funds into these budding ventures in return for an equity stake – usually minority shares but hoping that one day these small enterprises will flourish substantially, providing considerable returns upon exit via avenues like Initial Public Offerings (IPOs) or acquisitions by larger corporations.

Risk Profiles: PE vs VC

A key distinguishing factor between private equity and venture capital lies within their respective risk profiles. While private equities lean more towards lower-risk mature businesses boasting proven business models, VCs embrace higher risks associated with early-stage ventures, betting big on unproven ideas yet promising markets.

This difference also impacts how both types of firms manage post-investment portfolio companies. Given that PE investors acquire controlling stakes in more seasoned organizations, they wield greater influence over strategic decisions, including management team alterations if necessary, whereas VC investors, having smaller stakes, act mainly as advisors offering expertise and guidance without direct control over daily operations.

Funding Structures: How Funds Flow?

An interesting aspect is understanding how funds flow from investors through these two routes – PEs versus VCs. In the case of PE investments where large sums are involved upfront due to its buyout nature, it’s common practice among large PE firms to use leveraged buyouts wherein part financing comes from borrowed money,

Key Takeaway:

While private equity focuses on mature companies, seeking to enhance operations and boost profitability for a substantial profit margin, venture capital targets high-potential startups, betting big on unproven ideas with the hope of considerable returns upon exit. The risk profiles differ significantly; PE leans towards lower-risk ventures while VC embraces higher risks associated with early-stage businesses.

The Role of Private Equity Investors

When it comes to financing, private equity investors are a key component. They focus primarily on providing funds for businesses in distress or those that aren’t performing up to their potential. The goal? To turn these companies around and sell them at a profit.

This approach often involves acquiring majority stakes in the companies they invest in. By doing so, private equity investors gain substantial control over how the business operates. This allows them to make necessary changes and guide the company towards profitability.

Beyond this, having such controlling interest provides flexibility when deciding exit strategies – if deemed beneficial, they can choose to sell off their stake entirely or partially whenever needed.

How to Choose the Right Private Equity Funds for Your Business

Selecting appropriate private equity funds is an essential step for entrepreneurs seeking this type of funding source. One important factor is reviewing an investor’s track record; partnering with those who have proven success rates may offer more reliable results.

You should also consider whether your prospective investor’s investment strategy aligns with your own business goals – some firms specialize within specific sectors while others maintain broader portfolios across various industries. Investopedia provides further insights into understanding different types of investment strategies used by PE firms.

Familiarizing yourself with management teams within possible PE partners could be illuminating as well since these individuals will likely influence future direction post-investment – ensuring alignment between both parties’ visions becomes critical here.

Last but not least, fund size matters too because larger funds usually possess greater resources which might significantly benefit ventures like yours.

Considering unsecured business loans as alternative financing options might appeal particularly if you prefer not dealing with stringent requirements from VC investors or don’t want to give ownership stakes away.

Key Takeaway:

Private equity investors are financial lifesavers for struggling businesses, buying majority stakes to steer them towards profitability. Picking the right PE fund requires reviewing track records, ensuring investment strategies align with your goals, understanding management teams and considering fund size. Unsecured business loans can be a viable alternative if you’re wary of giving up ownership.

Understanding Venture Capital (VC) Funding

Venture capital, or VC funding as it’s commonly known, is a crucial player in the world of startups and young companies. Unlike private equity investors who are more inclined towards mature businesses, venture capital firms have their sights set on new enterprises that demonstrate high growth potential.

The primary objective of VC funding extends beyond mere financial support; it also encompasses industry expertise and strategic guidance. This dual approach helps to minimize risk while maximizing success prospects. A defining characteristic distinguishing venture capitalists from other types of investors is their readiness to take calculated risks by investing in untested business models with significant upside potential.

How to Raise Venture Capital Funding

To raise venture capital requires careful planning and strategy execution. The journey begins with creating an engaging pitch deck that effectively communicates your business model, market opportunity, competitive edge along with revenue projections among others.

Finding suitable VC firms whose investment philosophy aligns well with your company’s stage and sector can make all the difference when seeking funds for expansion or scaling up operations. Investopedia provides detailed insights about each step involved in this process including useful tips based on real-world experiences shared by successful entrepreneurs.

Negotiating terms once you’ve caught the attention of a VC firm forms another critical part of raising funds. Key aspects such as valuation cap or discount rate need thorough consideration during this phase. To learn more about these concepts, refer to our article “Forbes: How To Raise Venture Capital Funding For Your Startup?”.

Venture Capital isn’t just about funds, it’s also strategic guidance for startups. It involves calculated risks and potential high returns. Looking to raise VC? Start with a solid pitch deck and find the right firm that aligns with your vision. #Startups #VCfClick to Tweet

Private Equity vs Venture Capital: Key Differences Explained

In the world of investment banking, private equity firms and venture capital firms play significant roles. However, they differ in their approach to investments. While private equity investors typically focus on mature companies with stable cash flows, venture capital (VC) funding is usually directed towards high-growth startups that may not yet be profitable.

Their target companies also vary greatly.

Mature businesses needing operational improvements or strategic direction are often sought out by private equity investors. On the flip side, innovative enterprises with disruptive technologies or business models having significant growth potential attract VC investors.

Differences in Control Stakes

A crucial distinction lies within control stakes involved during investing. Typically, private equity investments involve acquiring a majority stake, setting them apart from venture capitalists who tend to acquire minority stakes but provide valuable guidance for startups’ rapid growth.

This variation stems from different risk profiles associated with each type of investment. The predictable returns offered by mature companies targeted by private equity firms require hands-on management, necessitating controlling interest. On the other hand, VCs deal more flexibly due to the nature of the startup ventures they invest in.

Varying Working Hours & Competitive Environment

The demanding nature of due diligence processes undertaken during acquisitions means longer work hours for professionals at large private equity firms compared to those at VC firms, who primarily focus on post-investment phase portfolio management.

The competitive environment also varies significantly. While both sectors face stiff competition, corporate buyers and other private equity funds bid against large private equity firms for assets. In contrast, promising startup deals see VCs competing amongst themselves.

Discover the differences between private equity and venture capital. PE firms focus on mature companies, while VCs target high-growth startups. Plus, they differ in control stakes and work environments. #InvestmentBanking #PrivateEquity #VentureCapitalClick to Tweet

Prospects of Investment Banking in Private Equity

Investment banking serves as a launching pad for many professionals aiming to break into the private equity sector. These large PE firms are often filled with individuals who began their careers navigating the complexities of investment banking.

A closer look at why this transition is common reveals two key responsibilities: deal sourcing and due diligence.

The famous saying, “Knowledge is power,” applies perfectly here.

The more adept you become at these tasks within an investment bank setting, the better equipped you’ll be when transitioning to private equity roles.

Diving Deep Into Deal Sourcing

In both realms – investment banking and private equity – deal sourcing plays a pivotal role. This involves identifying potential investments or acquisition targets that align seamlessly with your firm’s strategy.

To excel in this area requires extensive industry knowledge, top-notch analytical skills, stellar networking abilities, and sharp market trend insights. All these competencies make seasoned investment bankers prime candidates for positions within PE firms.

Navigating Through Due Diligence Process

No matter if it’s an IPO transaction or M&A activity happening on Wall Street; the due diligence process forms another crucial responsibility shared between investment banks and private equity investors alike.

This task demands thorough assessments on prospective deals before making any commitments – evaluating financial statements, scrutinizing business models and plans, assessing management teams among other things during transactions.

Your expertise developed through years spent evaluating such aspects can prove invaluable while performing similar evaluations at PE firms considering portfolio companies for investments.

Investment banking is a springboard to private equity, honing skills in deal sourcing and due diligence. It’s about mastering the art of identifying potential investments and meticulously evaluating them before committing. #PrivateEquity #InvestmentBankingClick to Tweet

Decoding Majority Stake Acquisition by Private Equity Investors

Unravelling the enigma of private equity, especially when it involves procuring a majority share in an established business, can be puzzling and alluring. This strategy allows these investors to secure more than 50% ownership, giving them substantial influence over business operations and strategic decisions.

This control can be seen as both an opportunity and responsibility for value creation.

Akin to Benjamin Franklin’s quote “If you fail to plan, you are planning to fail”, acquiring a controlling interest requires careful planning. The goal? To drive operational improvements that enhance performance, ultimately leading to higher profitability on exit if their strategies prove successful.

Digging Deeper into Benefits of Acquiring a Majority Stake

To fully understand this investment approach, we need to first consider its advantages. Investopedia offers insightful resources about owning majority interests, which may provide further clarity here.

- Gaining decision-making power: With significant shareholding comes increased input into major business strategies such as mergers & acquisitions or financial restructuring.

- Potential for greater returns: If implemented strategies lead successfully towards improved company valuation upon exit.

Risks Involved with Majority Stake Acquisition: A Closer Look

- An inherent risk associated with this strategy is complete accountability for any losses due to poor management decisions or unexpected market downturns. For detailed insights on understanding risks involved with PE investments compared to VC funding methods, Corporate Finance Institute’s resource page could be helpful.

- Firms must perform thorough due diligence before deciding on this kind of investment because failure could result in considerable monetary loss given the large exposure through holding a controlling interest, especially when comparing other financing options like unsecured business loans. These carry less stringent requirements from private equity investors or VC investors, making them attractive alternatives too at times depending on the circumstances faced by business owners looking to raise funds without ceding much control of their venture.

Key Takeaway:

In the high-stakes game of private equity, acquiring a majority stake is akin to holding all the cards. It’s an opportunity for significant influence and potential profits but comes with risks and responsibilities. Without careful planning, you’re setting yourself up for failure – so play your hand wisely.

Exploring Unsecured Business Loans as an Alternative Funding Option

They need capital for growth but are hesitant about the stringent requirements of private equity investors or VC investors. This is where unsecured business loans come into play.

The appeal of unsecured business loans lies in their accessibility and flexibility.

In contrast to raising funds from PE firms or venture capital firms that may require giving up ownership stakes, these types of loans offer financial support without diluting your control over your enterprise. The fact that they do not necessitate collateral makes them particularly attractive for businesses lacking substantial assets yet needing immediate cash infusions.

Benefits & Drawbacks of Unsecured Business Loans

Digging deeper into this financing option, one finds both benefits and drawbacks worth considering before making a decision.

An undeniable advantage is speed; compared with other forms such as VC funding or investment banking which involve complex procedures and longer timelines, securing an unsecured loan can be relatively quick. This allows you to respond promptly when opportunities knock at your door – something crucial especially for startups aiming for high growth rates amidst competitive markets.

Your company retains full autonomy since there’s no exchange equity stake involved unlike dealing with large PE or VC investments that might demand majority acquisition, thus offering greater freedom to manage operations the way you see fit. However, despite all the positives, one mustn’t overlook the potential downsides associated too. Lenders may levy higher rates to cover the risk, which could lead to more expensive borrowing if revenue is not enough to make up for it. Secondly, the lack of physical asset backing leaves the lender with less recourse in the event of non-payment, resulting in stricter penalties including legal actions and a negative impact on credit score. Hence, careful consideration is essential when weighing the pros and cons to determine whether it is the right choice for your specific circumstances.

Key Takeaway:

Unsecured business loans offer a speedy, flexible funding option for businesses wary of giving up control to private equity or venture capital investors. However, the trade-off includes higher interest rates and potential legal repercussions if default occurs. It’s all about weighing your options carefully.

Conclusion

You’ve seen the inner workings of these two financial giants.

Their distinct roles in shaping businesses, from startups to mature firms, are now clear as day.

From private equity’s focus on distressed or established companies to venture capital’s eye for high-growth potential startups – it all makes sense now.

You’ve also understood how control stakes differ between them. Majority rule is the game for private equity investors while VC firms play a more advisory role with minority stakes.

We delved into alternative funding options too, like unsecured business loans that offer freedom from ownership dilution worries.

Investment banking’s prospects within private equity were explored as well. A stepping stone towards big PE dreams!

All this knowledge can be your power tool in making informed decisions about raising funds or investing wisely in businesses. Forge ahead confidently!

If you want to learn more about this, sign up for my newsletter.