Entering the world of private equity fund structure can seem like a daunting challenge, especially when you’re new to the investment industry.

Browsing financial forums and LinkedIn posts, it’s not uncommon to see people expressing confusion about how these funds are set up and managed.

“You need years of experience in finance or business management to understand private equity.”This simply isn’t true.

The truth is that understanding private equity fund structure requires some effort but it’s certainly achievable even for those who are just starting out in their investment journey.

The Intricacies of Private Equity Fund Structure

Private equity funds, known for their investment in private companies and potential high returns, have a complex structure. They bring together capital from institutional investors such as pension funds or family offices along with wealthy individuals to invest in the vast landscape of approximately 6 million private companies.

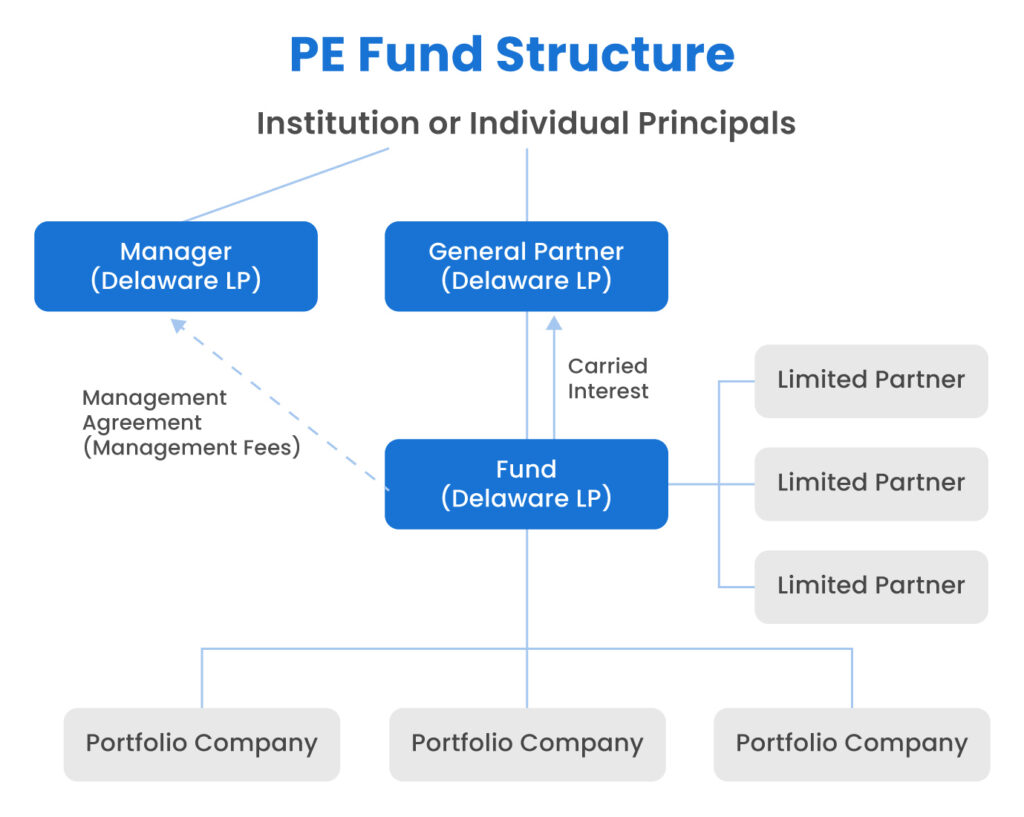

Digging into Management Companies and General Partners Roles

In any given fund’s life, management firms play an integral role by overseeing daily operations like sourcing deals, conducting due diligence on prospective investments, managing portfolio companies after acquisition, and strategizing exit plans. Their active involvement ensures the successful execution of the fund’s strategy.

General partners (GPs), often part of these management entities or closely associated with them, are tasked with making critical decisions about resource allocation within each private equity investment. The GPs also contribute some portion of their own money alongside limited partners’ contributions, which helps align interests between both parties involved.

Fund Structuring: Limited Liability Company vs Limited Partnership

Deciding between an LLC and LP to form a PE firm is often challenging for new entrants in the field, with varying tax implications and investor relations associated with each. Each type offers its benefits but differs significantly when it comes down to tax implications and investor relations.

An LLC provides more flexibility regarding profit distribution among members while LPs remain favored amongst most PE firms because they allow income pass-through directly to individual partners, avoiding double taxation at the corporate level. However, the final decision largely depends on various factors including size, type, and geographic location. Learn how different types impact your choice here.

Understanding the complex structure of private equity funds: from management roles to fund structuring, every decision impacts potential high returns. #PrivateEquity #InvestmentStrategyClick to Tweet

Decoding Private Equity Fund Size

The size of a private equity fund isn’t determined arbitrarily. It is meticulously calculated based on several factors, including the number of investors or limited partners, average deal size, and the expected number of deals the fund will invest in during its investment period.

A common misconception: Bigger is always better.

This is not necessarily true when it comes to private equity funds structured with limited partnerships or limited liability companies. A larger fund does not guarantee superior returns. Success depends on various variables such as effective strategy execution, management team expertise, and prevailing market conditions. This research provides valuable insights into how these elements influence the sizes of PE funds.

Digging into the Number Of Investors

In any given private equity firm, each investor contributes capital to raise the total corpus for investments in portfolio companies. More investors usually mean more substantial resources available for allocation across various opportunities within their target sectors.

Limited partners can be diverse entities, ranging from institutional investors like pension funds to high-net-worth individuals seeking higher potential returns than those typically offered by public stock exchanges. However, it is important to note that only 2% of the US population qualifies as eligible personal investors in PE Funds according to current regulations.

Parsing Average Deal Size & Expected Number Of Deals

Fund managers also need to consider prospective transaction volumes when deciding on the overall pool size. If they aim for bigger acquisitions or buyouts, they will naturally require greater capital commitments from their backers, potentially leading to increased fundraising targets.

The anticipated volume also plays a critical role here. If there are many lucrative prospects lined up over the course, it would be necessary to have ample reserves ready, which could again lead to an increase in the desired sum raised initially.

Key Takeaway:

Private equity fund size isn’t a random figure; it’s meticulously calculated based on factors like investor count, average deal size, and expected deal volume. Bigger doesn’t always mean better returns – success hinges on strategy execution, management expertise, and market conditions.

The Appeal of Private Equity for Businesses

As an entrepreneur, you may be exploring different methods of obtaining capital to facilitate your business’s expansion. One such avenue that has been gaining traction in recent years is private equity investment.

This approach offers several unique advantages over traditional funding methods.

A key factor that sets private equity apart from other forms of financing is the concept of smart capital. This means PE firms don’t just invest money into businesses; they also bring their expertise and industry connections to help portfolio companies grow faster than they could on their own.

Flexibility and Commitment: The Cornerstones of PE Investment

In contrast with public stock exchanges or bank loans, private equity provides a high degree of flexibility, which allows entrepreneurs more freedom in executing their strategic plans without worrying about short-term financial pressures or shareholder demands.

Besides this flexibility, another appealing aspect lies in the commitment demonstrated by private equity firms towards ensuring success for their investments. Such dedication often extends beyond mere monetary support – it involves active participation at board-level decisions where valuable insights are provided based on extensive experience across multiple industries.

Leveraging Networks & Resources through Private Equity Partnerships

An additional advantage offered by partnering with a PE firm comes via access to vast networks comprising potential customers, suppliers, as well as experts within relevant fields who can provide invaluable advice when needed most.

Moving further than networking benefits alone, many established funds even offer resources like dedicated teams specializing in areas including HR software implementation and merger integration. These services would otherwise prove costly if sourced independently, especially for small- and medium-sized enterprises (SMEs).

Note:

While there’s no denying the myriad reasons making engagement with private-equity partners attractive, it should be remembered this type of finance isn’t suitable for all organizations due to its distinct characteristics, longer lock-in periods, and increased scrutiny compared to other types of backing. Careful consideration is therefore essential before taking the plunge.

Key Takeaway:

Private equity (PE) offers businesses not just financial backing, but also industry expertise and access to vast networks. This ‘smart capital’ approach provides flexibility and commitment that can accelerate growth. However, due to its unique characteristics, it may not suit all organizations.

Understanding Limited Partnership Agreements in PE Funds

private equity fund structure: In the intricate world of private equity funds, nothing is more foundational than a well-structured Limited Partnership Agreement (LPA). This document shapes the relationship between general partners and limited partners. The former group takes on management duties while the latter typically consists of institutional investors or family offices that contribute capital but stay away from daily operations.

The LPA: A Comprehensive Guide to Fund Operations

An LPA isn’t just an agreement; it’s a comprehensive guide outlining every aspect of fund operation. It specifies roles for both general and limited partners, sets governance rules, outlines investment restrictions for portfolio companies, defines fee structures like management fees or performance-based incentives. Furthermore, it also details risk distribution among participants and terms related to the life cycle of a fund, including its investment period as well as exit strategies such as initial public offerings or strategic acquisitions.

Risk Management through LPAs

A significant part played by LPAs within any private equity firm involves managing potential risks tied with investments made into target companies.

These agreements ensure strict adherence by General Partners to agreed-upon guidelines when investing raised capital from their Limited Partnerships.

Besides this critical function, a properly drafted LPA can act as safeguards against possible conflicts arising out of GPs’ profit motives versus fiduciary responsibilities towards LPs.

Negotiating Terms Within An LPA – A Crucial Stage In Private Equity Investment Process

Drafting an effective partnership agreement requires negotiation skills during the formation stage where key provisions are decided upon.

This phase often revolves around topics like clawback provisions – which demand GPs return previously distributed profits if future losses occur – carry waterfalls determining order & proportionality in distributing returns amongst various stakeholders etc.

To successfully navigate these contentious issues demands understanding not only how firms work but also how they don’t invest at times based on stipulations outlined within their respective LPAs.

Key Takeaway:

In the private equity sphere, a well-drafted Limited Partnership Agreement (LPA) is crucial. It defines roles, sets governance rules, outlines investment restrictions and fee structures, manages risks tied to investments and resolves potential conflicts. Effective negotiation during its formation can determine successful outcomes for all parties involved.

Unraveling Revenue Generation in Private Equity Firms

In the complex world of private equity, firms generate revenue primarily through two streams: management fees and performance fees. Each plays a distinct role within the fund’s life.

Let’s dissect these income sources:

The Tale of Management Fees versus Performance Fees

A staple in any private equity industry setup is management fee – typically charged as a percentage of total assets under management (AUM). This consistent source ensures that operational expenses like salaries or research costs are covered without hiccups. The rate usually hovers around 2%, but it may vary based on factors such as fund size. Find out more about this here.

Moving onto performance fees, also known as carried interest – they act to incentivize successful investments aligning interests between investors and fund managers. These charges come into play when portfolio companies yield profits surpassing set benchmarks (the ‘hurdle rate’). A common figure for this share stands at 20%. Learn how carried interest works here.

Diversification Beyond Traditional Revenues

Beyond these traditional avenues, some PE firms have started diversifying their business models by providing advisory services or creating specialized funds targeting specific sectors.

This not only provides an additional stream of income but also allows them to leverage their expertise across different areas within the financial markets.

These diversified strategies reflect changes both within investor expectations and broader market trends shaping future fundraising activities in the realm of private equity.

Fees Controversy In Private Equity Industry

The dual-fee structure has been subject to criticism due to potential conflicts arising from prioritizing short-term gains over long-term value creation for limited partners. Precisely why transparency regarding fee structures becomes increasingly important within the ecosystem.

Unraveling the revenue maze in private equity firms. It’s a tale of management fees vs performance fees, diversification strategies, and fee controversies. Stay informed about your investments. #PrivateEquity #InvestmentInsightsClick to Tweet

Phases in Private Equity Fund Lifecycle

The lifecycle of a private equity fund is a complex process that consists of four distinct phases. Each phase has its own set of objectives and challenges, requiring expertise and strategic planning skills from the fund managers.

Fundraising Phase

This initial stage involves raising capital for investment purposes. The fundraising period can span several months to over a year, depending on market conditions and the reputation of the management team within industry circles.

Potential limited partners assess factors such as proposed investment strategies by general partners before committing their resources. Remember, only about 2% of the US population is eligible to personally invest in PE funds.

Sourcing & Transacting Deals Phase

In this second phase, private equity firms diligently seek out promising companies ripe for acquisition. This requires comprehensive due diligence, including financial analysis, extensive research into industry trends, and one-on-one meetings with company leadership teams.

Managing Portfolio Companies Phase

During this third phase known as ‘managing portfolio companies’, the focus shifts towards creating value through operational improvements or the implementation of strategic initiatives. Unlike hedge funds, which might adopt passive roles post-investment, private equity firms actively engage with company leaders aiming to drive growth and increase profitability.

Exiting Strategies for Maximum Returns:

Navigating the complex lifecycle of a private equity fund involves strategic planning, diligent sourcing, active management and savvy exiting strategies. #PrivateEquity #InvestmentStrategyClick to Tweet

Demystifying Common Misconceptions About Private Equity

In the world of investments, private equity often remains shrouded in misconceptions and complexities. Let’s debunk some common myths.

The Interchangeability Myth: Private Equity vs Venture Capital

One widespread misconception is equating private equity with venture capital. Although both are forms of alternative investment strategies involving companies outside public stock exchanges, they serve distinct purposes and stages of a business lifecycle.

Venture capitalists typically target early-stage startups exhibiting high growth potential albeit accompanied by substantial risk factors. On the contrary, private equity firms invest predominantly in mature businesses seeking to accelerate their growth or enhance operational efficiencies.

A noteworthy distinction lies within control dynamics; while venture capitalists provide strategic guidance without necessarily seeking decision-making authority over company operations, PE funds usually acquire controlling stakes enabling them direct influence on management decisions. Here’s an overview that provides more insights into these differences.

A prevalent misunderstanding revolves around investor eligibility for participating in PE funds. The reality might surprise you – only about 2% of the US population qualifies as accredited investors eligible for personal investment directly into such funds.

This doesn’t imply, though, that average individuals can’t indirectly benefit from this asset class through pension plans or mutual fund allocations which may have exposure towards such alternate assets.

The structure and functioning mechanism of PE Funds also remain misunderstood due largely because each fund’s life cycle varies based on its specific objectives & strategies.

For instance, many believe all limited partners (LPs) participate equally whereas LP agreements may stipulate different classes offering varying rights & obligations depending upon factors like commitment size & timing etc., thus adding another layer of complexity into understanding how these firms work.

Key Takeaway:

Busting the myth: Private equity isn’t synonymous with venture capital – they target different business stages and wield varying control levels. Also, only a small fraction of Americans can directly invest in PE funds, but many indirectly benefit via pension plans or mutual fund allocations.

Conclusion

Private equity fund structure is a labyrinth worth navigating.

The complexities can be daunting, yet they’re not beyond conquering.

Management companies and general partners play key roles in steering the ship.

Fund size isn’t about being the biggest, it’s about striking the right balance for maximum returns.

Businesses find private equity alluring due to its smart capital and flexibility among other benefits.

Limited Partnership Agreements set clear rules of engagement within PE funds.

private equity fund structure

In revenue generation, management fees and performance fees hold sway.

A lifecycle of a PE fund involves phases like fundraising, deal sourcing & transacting, managing portfolio firms & devising exit strategies.

IPOs or strategic acquisitions often serve as profitable exits for these funds.

Misconceptions abound around private equity; it’s not venture capital nor is it accessible to everyone.

Dive deep into this world of high-stakes investing – you’ll emerge with insights that can transform your financial future!

If you want to learn more about this, sign up for my newsletter.